why is actblue not tax deductible

Charity Navigator does not currently have the data required from e-filed IRS Forms 990 for Actblue Charities Inc. An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the DCCCs sole discretion.

Are My Donations Tax Deductible Actblue Support

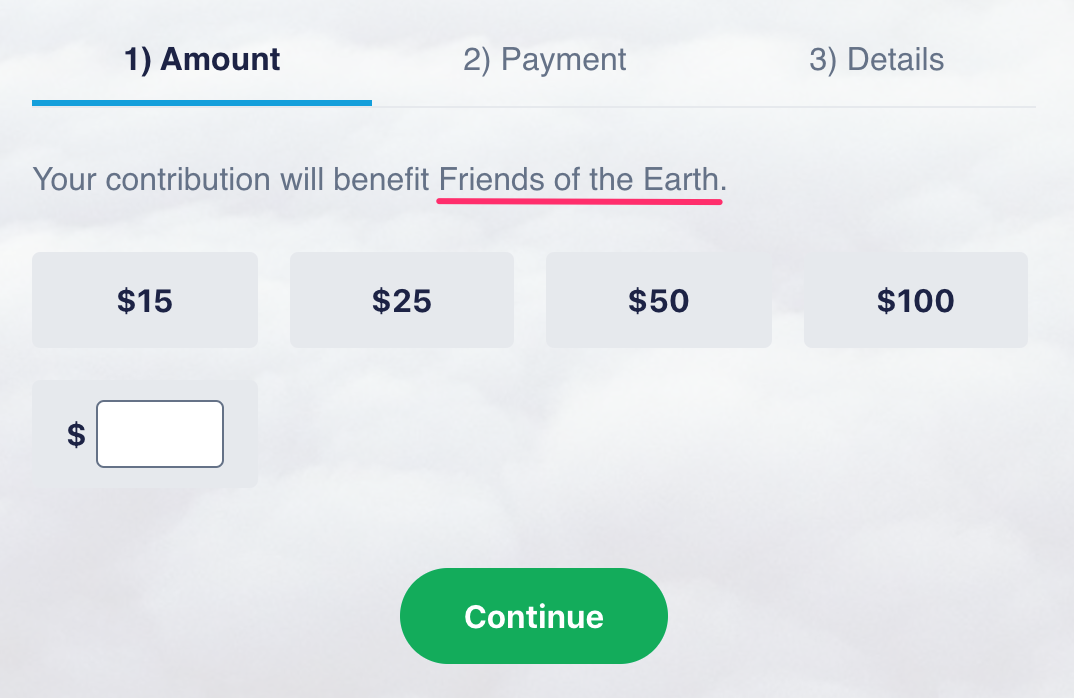

We give you the option to leave a tip for us on your contributions so you can support our platform and fuel our work.

. First we are a mission-driven organization. Contributions or gifts to ActBlue are not deductible as charitable contributions for. ActBlue is a people-powered nonprofit.

Paid for by ActBlue Civics. While ActBlue is organized as a political committee we act as a conduit for individual contributions made through our platform we do not make contributions ourselves. If you would like to contribute to EMILYs List using ActBlue please visit this link.

Similarly left-wing advocacy groups such as Demand Justice fundraise through ActBlue Civics the 501c4 arm while Democratic PACs and campaigns. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Theres just a 395 processing fee on all transactions.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Under federal law these contributions are made by individuals. If ActBlue is non-profit and nearly ALL the money goes to entities and candidates with no financial benefit flowing to the donor why isnt a donation tax deductible.

Being a nonprofit allows us to focus on our mission of empowering small-dollar donors and build tools that work not just for presidential candidates but also first-time school board candidates. Unless informed by the DCCC of a different allocation the next 109500 of an individuals contribution will be for the DCCCs recount fund and all amounts in excess of this. Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible.

By proceeding with this transaction you agree to ActBlues terms conditions. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. If ActBlue is non-profit and nearly ALL the money goes to entities and candidates with no financial benefit flowing to the donor why isnt a donation tax deductible.

Theres just a 395 fee to process credit card contributions which we pass along to the groups that use our tools. We do offer an ActBlue option for contributions made to EMILYs List. ActBlues mission is to build tech and infrastructure for Democratic campaigns progressive-aligned causes and people trying to make an impact in order to fuel long-term change.

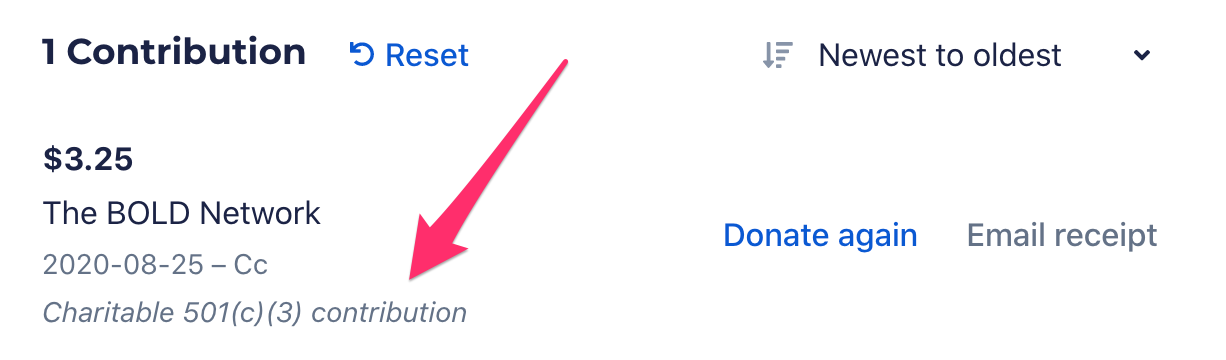

Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible. October 07 2020 2110. We process and send grassroots donations to the campaigns and organizations that use our fundraising platform.

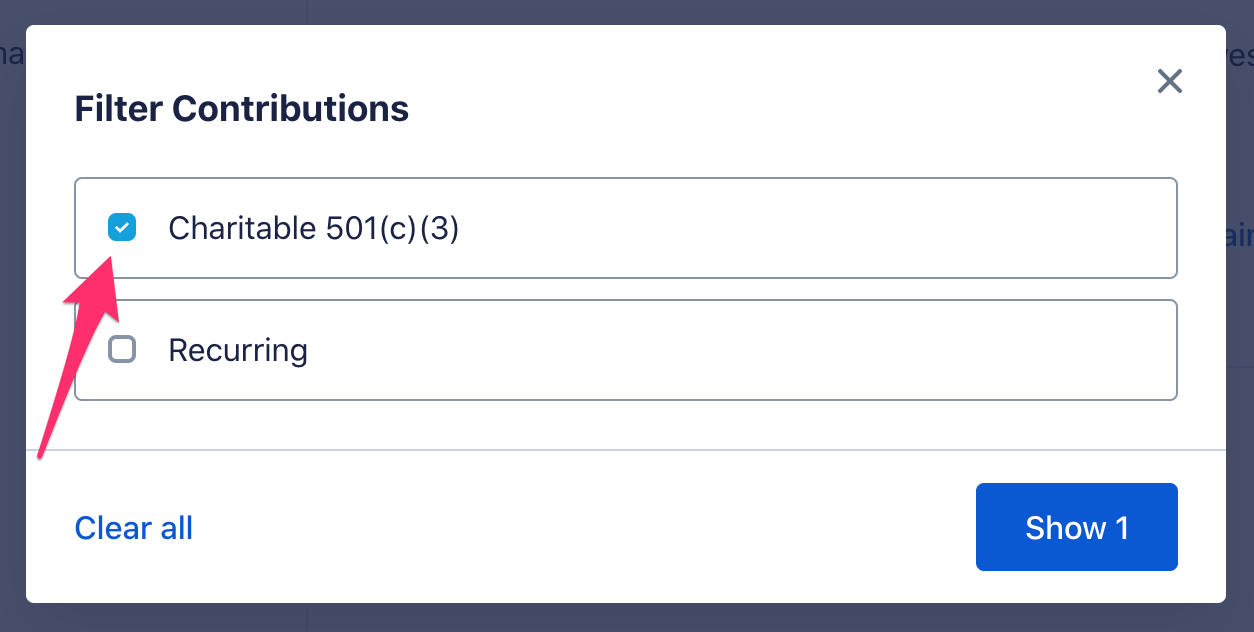

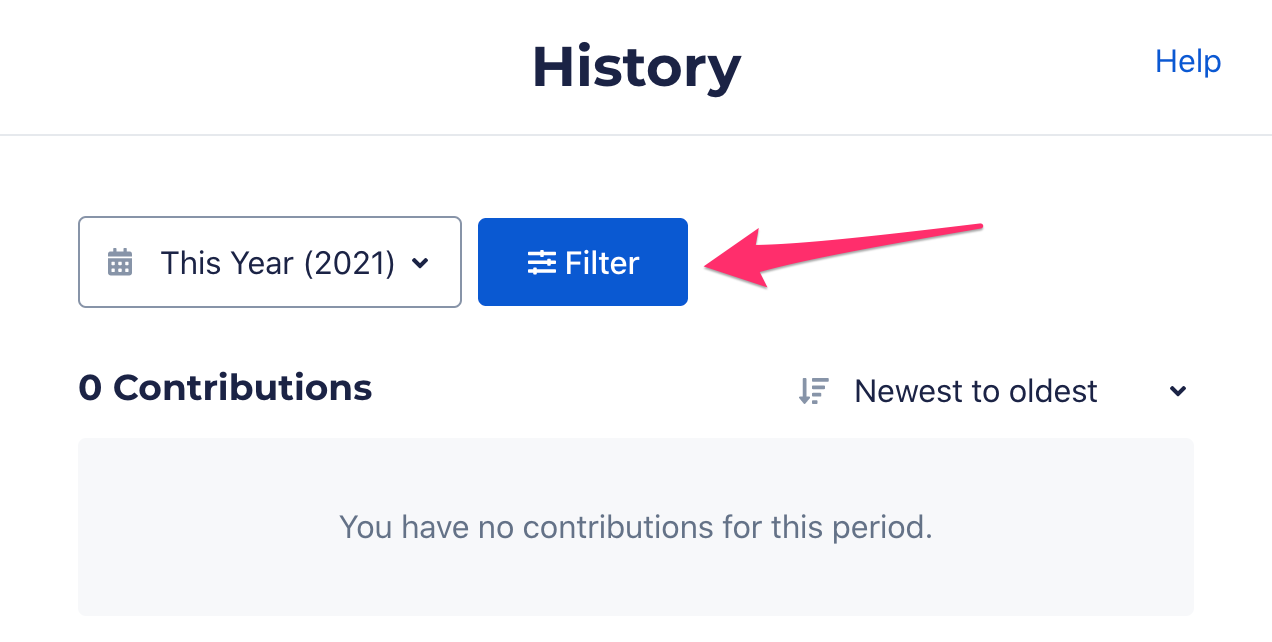

If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform. ActBlue is organized as a political action committee but we serve as a conduit for individual contributions made through our platform. May still be filing paper Forms 990.

This indicates that Actblue Charities Inc. When we build a new feature or run an AB test that helps conversion rates we can immediately roll that out to every group making us all smarter. Were a nonprofit for a few different reasons.

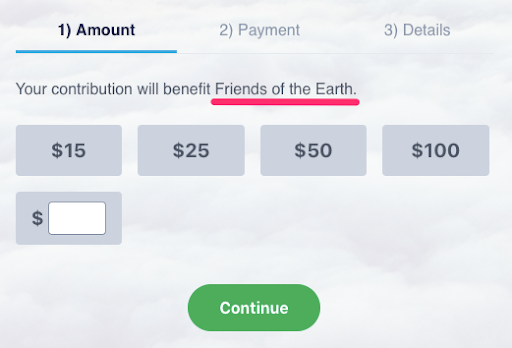

However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law Its website says. Form 8283 Noncash Charitable Contributions PDF.

We pass along a 395 processing fee on contributions to the groups using our platform. Its stated mission is to empower small-dollar donors. Were a nonprofit for a few different reasons.

The absence of a score does not indicate a positive or negative assessment it only indicates that we have not yet. They are not considered PAC donations. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

Because were a nonprofit our platform is powered entirely by the amazing small-dollar donors who invest in our work. Along the way the issue of ActBlue there was a link on TYTs site came up and I wanted to know why donations ARE NOT Tax deductible. Contributions or gifts to the DCCC are not tax deductible.

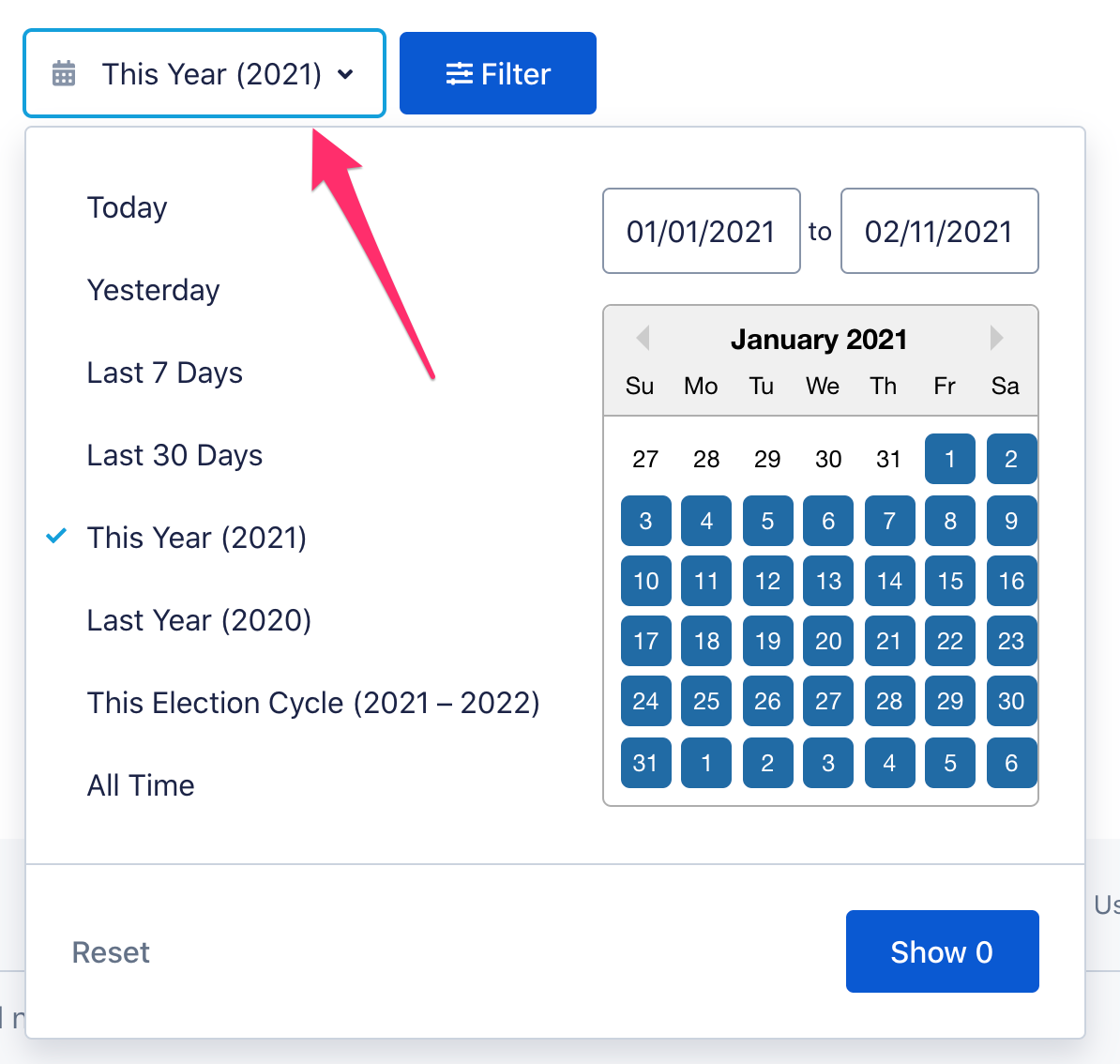

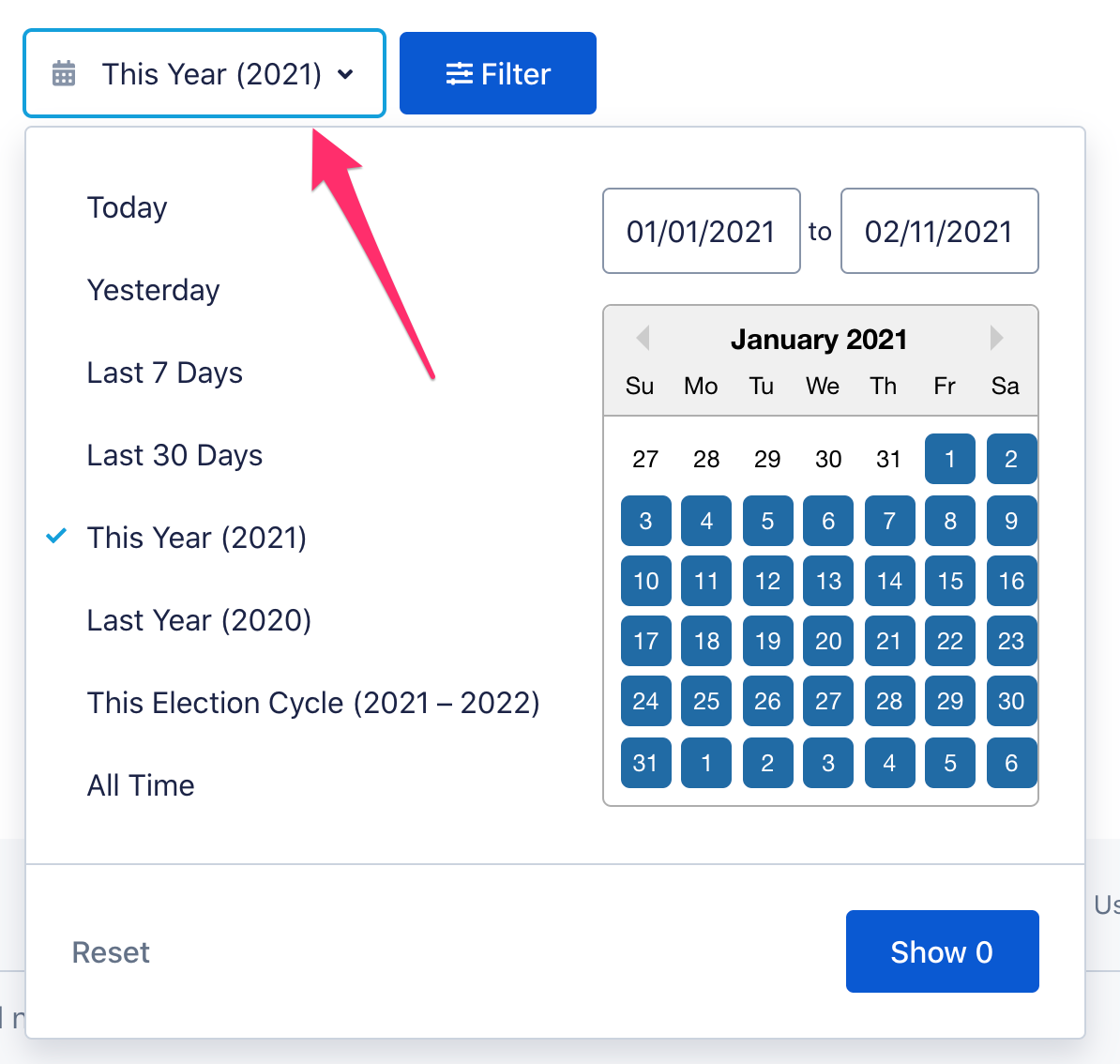

Once youre logged in you will immediately see the History page which. Thousands of campaigns and organizations rely on our fundraising tools which they use for no charge. If ActBlue is non-profit and nearly ALL the money goes to entities and candidates with no financial benefit flowing to the donor why isnt a donation tax deductible.

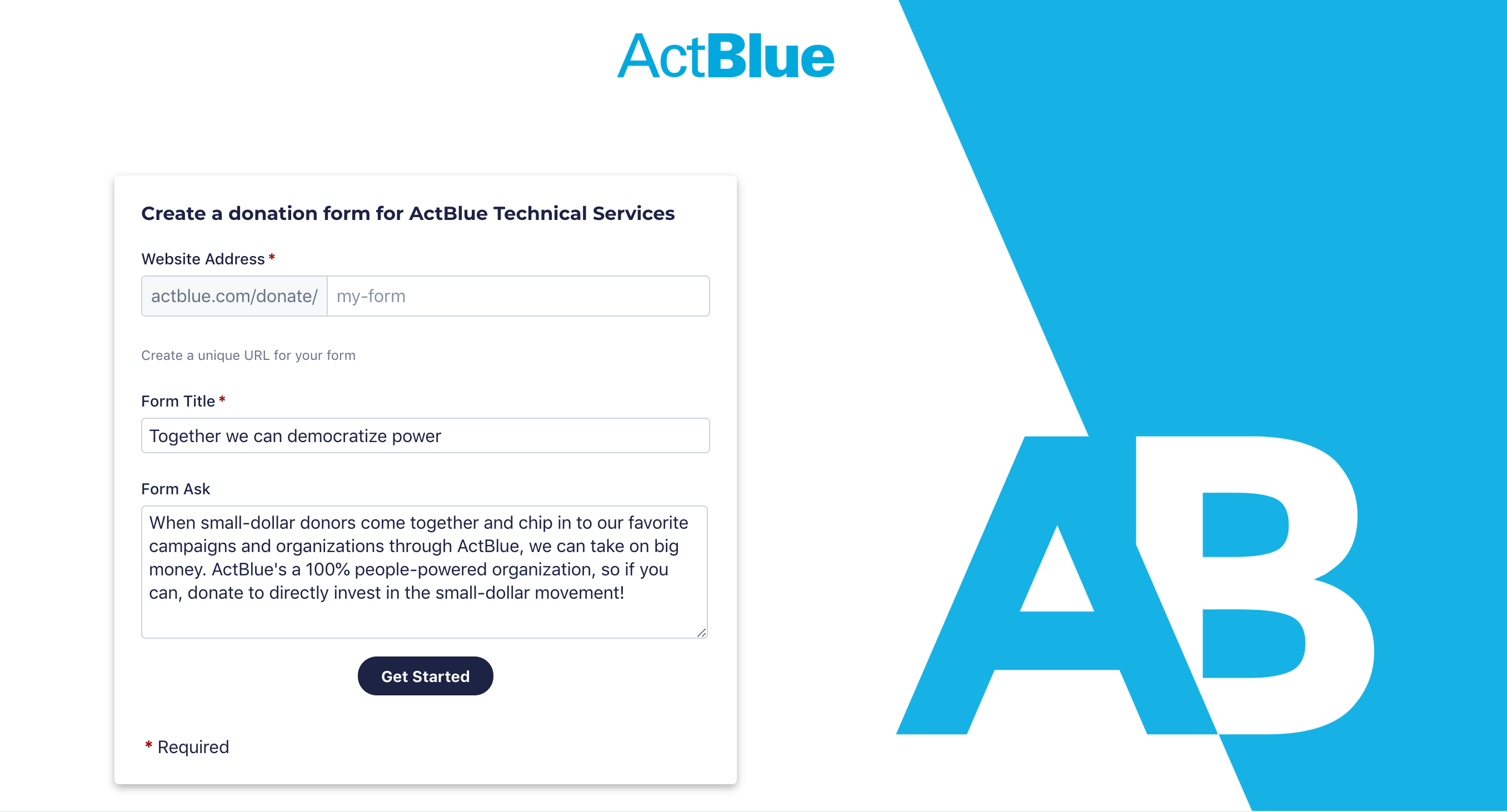

ActBlue is an American nonprofit technology organization established in June 2004 that enables left-leaning nonprofits Democratic candidates and progressive groups to raise money from individual donors on the Internet by providing them with online fundraising software. We provide our tools to campaigns and organizations at no cost. We envision a democracy where everyone looking to make.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. Tax Exempt Organization Search on IRSgov is a tool that allows users to search for tax-exempt charities. We do not fundraise or donate on behalf of anyone or choose candidates to support.

At the bottom of the page it clearly states. We provide the tools. An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the DCCCs sole discretion.

On second thought I didnt double check. Why is ActBlue considered a PAC. Under the law contributions made through ActBlue are not considered PAC donations.

By proceeding with this transaction you agree to ActBlues terms conditions. Laura EMILYs List Membership Services. ActBlue does not make money off of.

I Don T Remember Adding A Tip To My Contribution Actblue Support

Actblue Express Lane Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

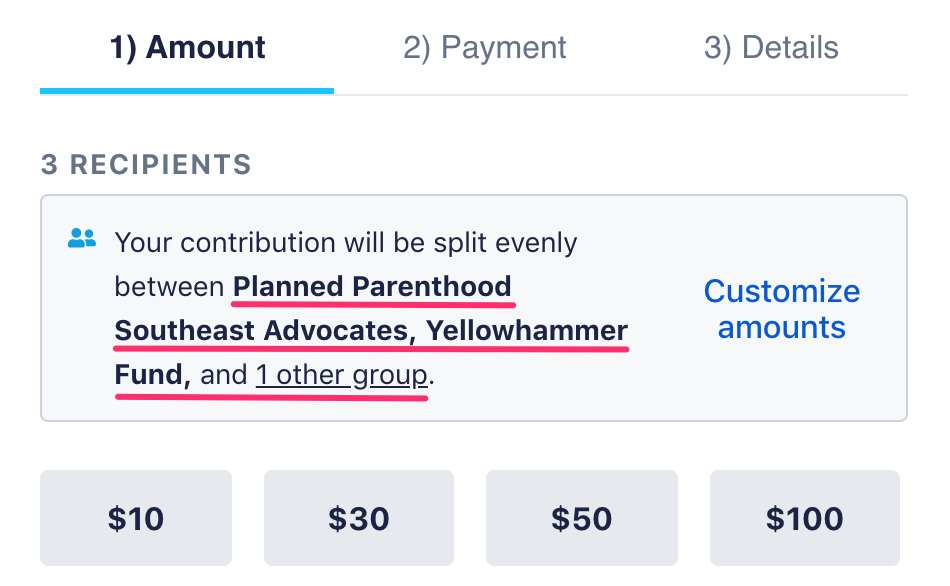

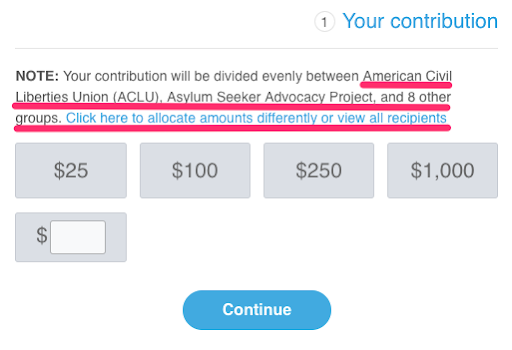

How Do I Know Who My Donation Is Going To Actblue Support

Are My Donations Tax Deductible Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

Why Don T I See My Donation History When I Log Into My Account Actblue Support

How Can I Look Up My Contribution Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

I Didn T Mean To Make A Recurring Donation What Do I Do Actblue Support

Sending Evaluating Contribution Forms Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

What Happens To My Money When I Donate Actblue Support

A Campaign Organization Sent Me A Link To Make My Own Fundraising Page What Do I Do Actblue Support

Are My Donations Tax Deductible Actblue Support

Will My Venmo Donations Be Visible In My Venmo Feed Actblue Support